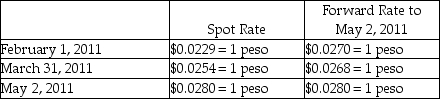

Wild West,Incorporated (a U.S.corporation)sold inventory to a company in the Philippines for 1,600,000 pesos on account on February 1,2011,with payment expected in 90 days.Wild West entered into a forward contract to hedge this transaction,and properly accounts for the transaction as a cash flow hedge.Wild West has a March 31 fiscal year end,and uses an 8% discount rate,resulting in a 30-day present value factor of .9934.The forward contract is settled net.The relevant exchange rates are shown below:

Required:

Required:

Record the journal entries needed by Wild West on February 1,March 31,and May 2.Round all entries to the nearest whole dollar.

Correct Answer:

Verified

Q24: Ivan has 14,000 barrels of oil that

Q25: On January 1,2011,Bosna borrowed $100,000 from Lenda.The

Q26: Onoly Corporation (a U.S.manufacturer)sold parts to its

Q27: On March 1,2011,Amber Company sold goods to

Q28: On December 18,2011,Wabbit Corporation (a U.S.Corporation)has a

Q30: On November 1,2010,Stateside Company (a U.S.manufacturer)sold an

Q31: On November 1,2010,Mayberry Corporation,a U.S.corporation,purchased from Cantata

Q32: On November 1,2011,Portsmith Corporation,a calendar-year U.S.corporation,invested in

Q33: Ferb Company is a U.S.-based importer of

Q34: On December 15,2011,Electronix Company purchased inventory from

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents