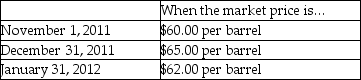

Ivan has 14,000 barrels of oil that were purchased a month ago at $50.00 per barrel.On November 1,2011 Ivan hedges the value of the inventory by entering into a forward contract to sell 14,000 barrels of oil on January 31,2012 for $60.00 per barrel.The forward contract is to be settled net.

Assume this is a fair value hedge.

Required:

Assume a 6% discount rate is reasonable,and using a mixed-attribute model,prepare the journal entries to account for this hedge at the following dates:

Correct Answer:

Verified

Q15: Taydus Corporation,a U.S.corporation,sold goods on December 2

Q19: Use the following information to answer the

Q21: On June 1,2011,Dapple Industries purchases an option

Q22: On November 1,2010,Ironside Company (a U.S.manufacturer)sold an

Q23: On January 1,2011,Bambi borrowed $500,000 from Lonni.The

Q25: On January 1,2011,Bosna borrowed $100,000 from Lenda.The

Q26: Onoly Corporation (a U.S.manufacturer)sold parts to its

Q27: On March 1,2011,Amber Company sold goods to

Q28: On December 18,2011,Wabbit Corporation (a U.S.Corporation)has a

Q29: Wild West,Incorporated (a U.S.corporation)sold inventory to a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents