Justice Corporation paid $40,000 cash for an 80% interest in the voting common stock of Grace Corporation on July 1,2012,when Grace's stockholders' equity consisted of $30,000 of $10 par common stock and $15,000 retained earnings.The excess cost over the book value of the investment was assigned $2,000 to undervalued inventory items that were sold in 2012,with the remaining excess being assigned to goodwill.During the last half of 2012,Grace reported $4,000 net income and declared dividends of $2,000,and Justice reported income from Grace of $1,200.

There were no intercompany sales during the last half of 2012,but during 2013 Justice sold inventory items that cost $8,000 to Grace for $12,000.Half of these inventory items were included in Grace Corporation's Inventory at December 31,2013,with $1,000 unpaid by Grace at December 31,2013.

On January 5,2013,Justice sold a plant asset with a book value of $2,500 and a remaining useful life of 5 years to Grace for $4,000.Grace Corporation owned the plant asset at year-end.The plant asset has no salvage value and both companies use the straight-line depreciation method.

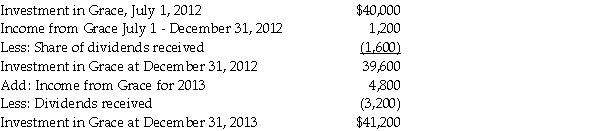

Justice Corporation uses the equity method to account for its investment in Grace,and the changes in Justice's Investment in Grace account from acquisition until year-end 2013 are as follows:

Required:

Required:

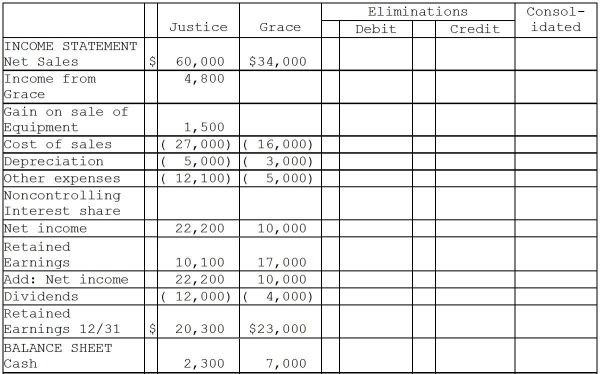

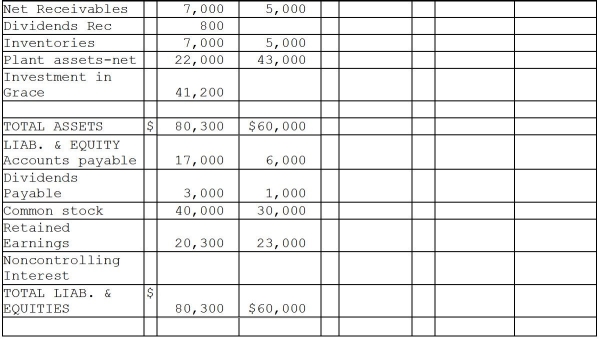

Complete the working papers for the year ending December 31,2013 that are given below.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q28: On September 1,2011,Beck Corporation acquired an 80%

Q29: On January 1,2010,Starling Corporation held an 80%

Q30: On December 31,2011,Potter Corporation has the following

Q31: At December 31,2012 year-end,Lapwing Corporation's investment in

Q32: On December 31,2011,Pat Corporation has the following

Q33: On September 1,2011,Nelson Corporation acquired a 90%

Q34: Candy Corporation paid $240,000 on April 1,2011

Q35: On January 1,2011,Fly Corporation held a 60%

Q36: On December 31,2011,Dixie Corporation has the following

Q37: At December 31,2010,the stockholders' equity of Pearson

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents