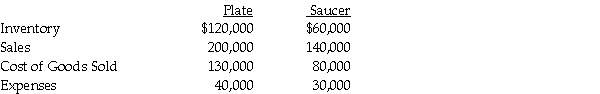

Presented below are several figures reported for Plate Corporation and Saucer Industries as of December 31,2011.Plate has owned 70% of Saucer for the past five years,and at the time of purchase,the book value of Saucer's assets and liabilities equaled the fair value.The cost of the 70% investment was equal to 70% of the book value of Saucer's net assets.At the time of purchase,the fair values and book values of Saucer's assets and liabilities were equal.

In 2010,Saucer sold inventory to Plate which had cost $40,000 for $60,000.25% of this inventory remained on hand at December 31,2010,but was sold in 2011.In 2011,Saucer sold inventory to Plate which had cost $30,000 for $45,000.40% of this inventory remained unsold at December 31,2011.

In 2010,Saucer sold inventory to Plate which had cost $40,000 for $60,000.25% of this inventory remained on hand at December 31,2010,but was sold in 2011.In 2011,Saucer sold inventory to Plate which had cost $30,000 for $45,000.40% of this inventory remained unsold at December 31,2011.

Required: Calculate following balances at December 31,2011.

a.Consolidated Sales

b.Consolidated Cost of goods sold

c.Consolidated Expenses

d.Noncontrolling interest share of Saucer's net income

e.Consolidated Inventory

Correct Answer:

Verified

Q30: Penguin Corporation acquired a 60% interest in

Q31: PreBuild Manufacturing acquired 100% of Shoding Industries

Q32: Plateau Incorporated bought 60% of the common

Q33: On January 1,2011,Palling Corporation purchased 70% of

Q34: Perry Instruments International purchased 75% of the

Q35: Pirate Transport bought 80% of the outstanding

Q36: Plover Corporation acquired 80% of Sink Inc.equity

Q37: Preen Corporation acquired a 60% interest in

Q38: Salli Corporation regularly purchases merchandise from their

Q39: Paulee Corporation paid $24,800 for an 80%

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents