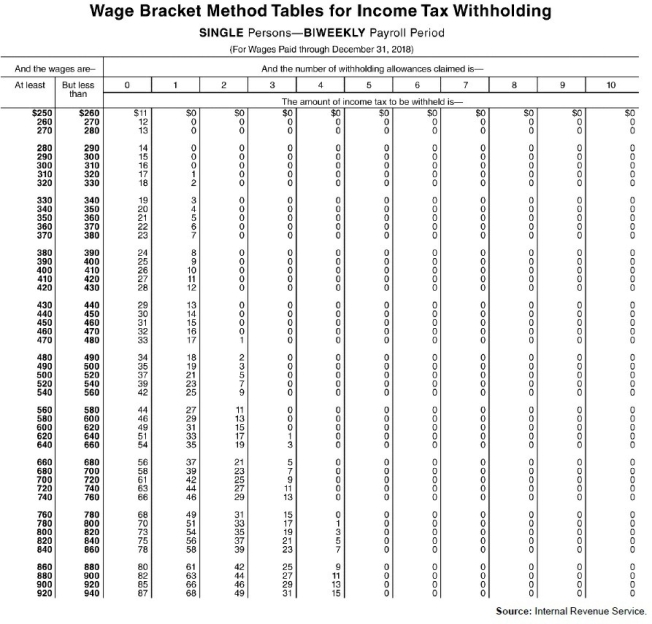

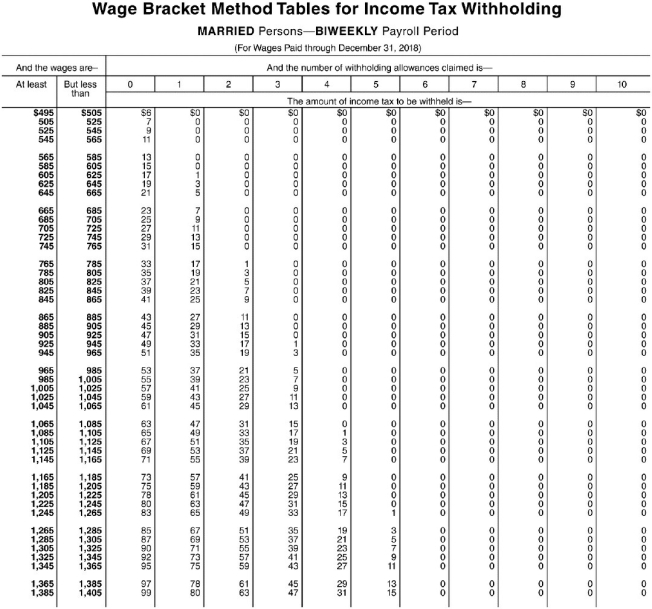

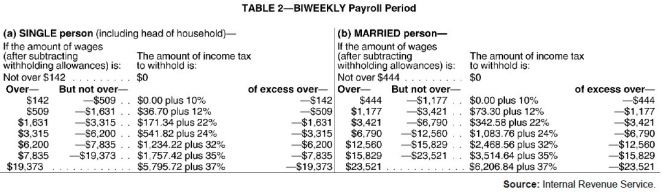

Exhibit 4-1:

Use the following tables to calculate your answers.

-Refer to Exhibit 4-1.Edward Dorsey is a part-time employee, and during the biweekly pay period he earned $395.In addition, he is being paid a bonus of $300 along with his regular pay.If Dorsey is single and claims two withholding allowances, how much would be deducted from his pay for FIT? There are two ways to determine his deduction- do not use table for percentage method.)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q42: Exhibit 4-1:

Use the following tables to calculate

Q43: Exhibit 4-1:

Use the following tables to calculate

Q44: A company must withhold federal income taxes

Q45: Exhibit 4-1:

Use the following tables to calculate

Q49: Arch gives you an amended Form W-4

Q50: A personal allowance:

A)amounted to $2,000 in 2019.

B)may

Q53: Which of the following forms is used

Q54: An employer must file an information return

Q57: To curb the practice of employees filing

Q58: Beech refuses to state her marital status

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents