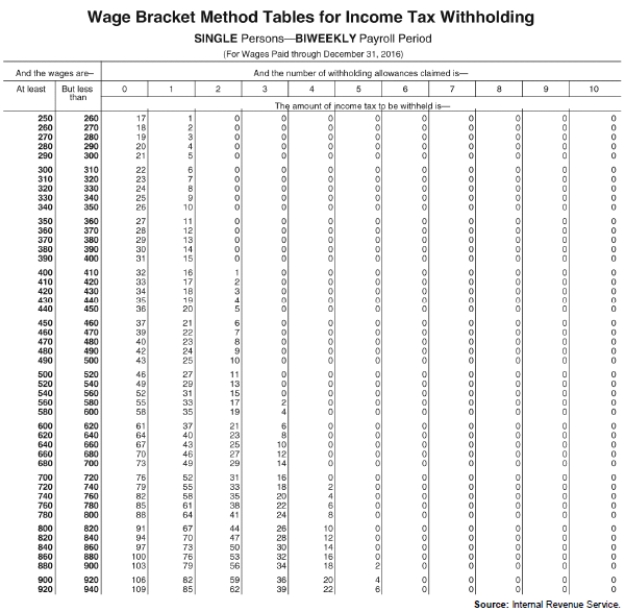

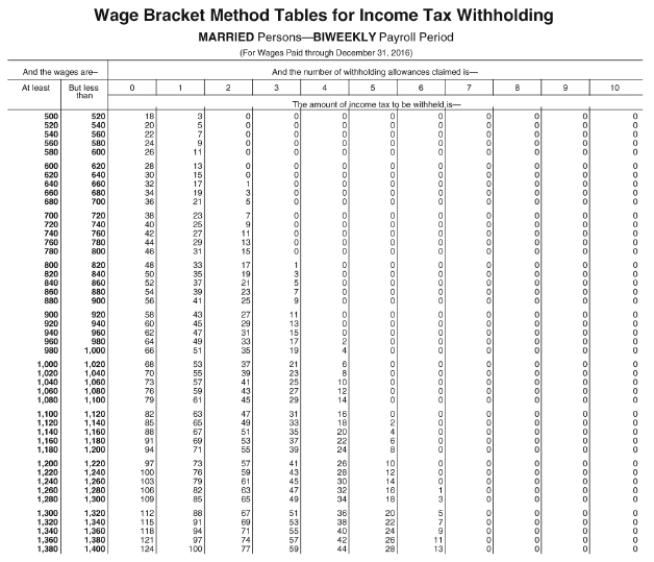

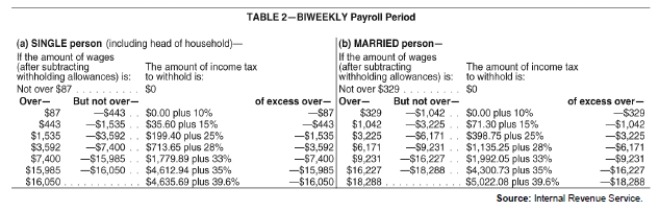

Exhibit 4-1:

Use the following tables to calculate your answers.

Source: Internal Revenue Service

Source: Internal Revenue Service

-Refer to Exhibit 4-1.Ted Duerson,previously unemployed for the calendar year,earned $13,200 during the biweekly period from September 29 to October 13 (20th payroll period).He has made a written request for the part-year employment method of withholding.If Duerson is married and claims zero withholding allowances,how much FIT tax would be withheld from his gross pay using the part-year employment method (using the wage-bracket table)?

Correct Answer:

Verified

Q42: A personal allowance:

A) amounted to $2,000 in

Q46: Exhibit 4-1:

Use the following tables to calculate

Q48: Exhibit 4-1:

Use the following tables to calculate

Q49: Which of the following forms is used

Q49: Exhibit 4-1:

Use the following tables to calculate

Q53: Which of the following forms is used

Q54: An employer must file an information return

Q55: Exhibit 4-1:

Use the following tables to calculate

Q56: Which of the following cannot be included

Q57: To curb the practice of employees filing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents