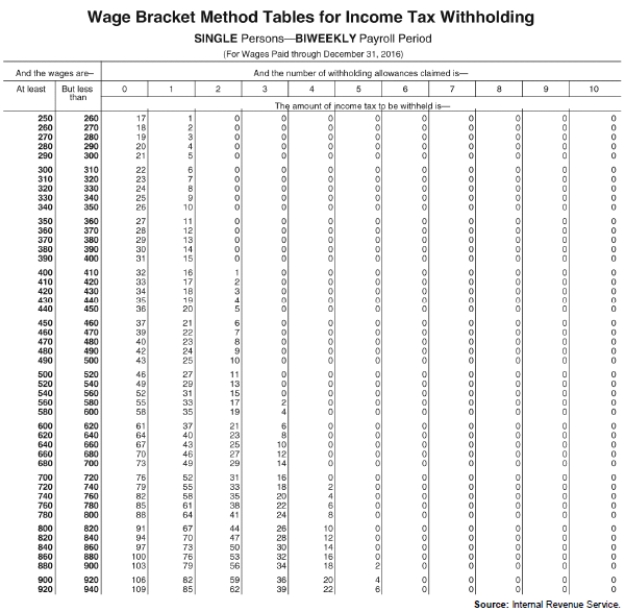

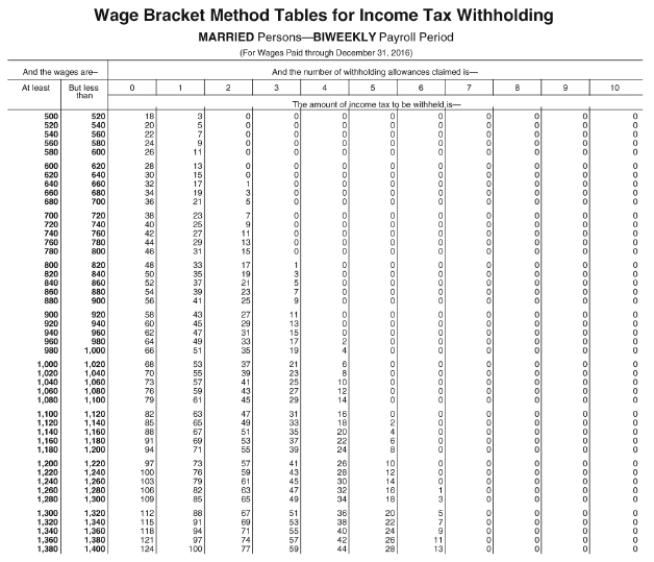

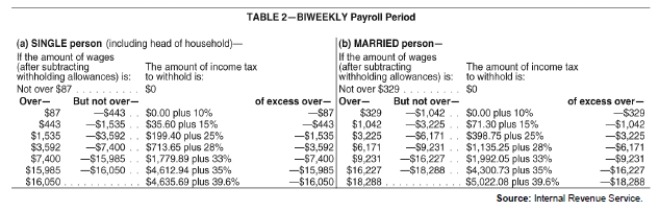

Exhibit 4-1:

Use the following tables to calculate your answers.

Source: Internal Revenue Service

Source: Internal Revenue Service

-Refer to Exhibit 4-1.Use the appropriate table to determine the amount to withhold for federal income tax from each of the following biweekly wages (biweekly withholding allowance = $155.80):

Patrick Patrone (single,2 allowances),$925 wages

__________

Carson Leno (married,4 allowances),$1,195 wages

__________

Carli Lintz (single,0 allowances),$700 wages

__________

Gene Hartz (single,1 allowance),$2,500 wages

__________

Mollie Parmer (married,2 allowances),$3,600 wages

__________

Correct Answer:

Verified

$ 24.00a

$ ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q46: Exhibit 4-1:

Use the following tables to calculate

Q47: Exhibit 4-1:

Use the following tables to calculate

Q49: Which of the following forms is used

Q49: Exhibit 4-1:

Use the following tables to calculate

Q53: Which of the following forms is used

Q53: Exhibit 4-1:

Use the following tables to calculate

Q54: An employer must file an information return

Q55: Exhibit 4-1:

Use the following tables to calculate

Q56: Which of the following cannot be included

Q57: To curb the practice of employees filing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents