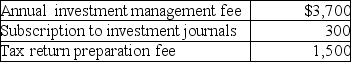

Nina includes the following expenses in her miscellaneous itemized deductions before application of the 2% of AGI floor:

Nina's AGI is $100,000.How much of the above-noted expenses will reduce her net investment income?

A) $4,000

B) $5,500

C) $3,000

D) $3,500

Correct Answer:

Verified

Q62: Teri pays the following interest expenses during

Q63: In 2016,Mario earned $9,000 in net investment

Q65: Phuong has the following sources of investment

Q65: Wayne and Maria purchase a home on

Q66: Investment interest expense is deductible

A)as an offset

Q68: On July 31 of the current year,Marjorie

Q71: All of the following statements are true

Q77: Valeria owns a home worth $1,400,000,with a

Q78: Which of the following is deductible as

Q80: Takesha paid $13,000 of investment interest expense

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents