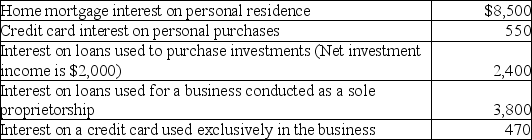

Teri pays the following interest expenses during the year:

What is the amount of interest expense that can be deducted as an itemized deduction?

A) $10,500

B) $10,900

C) $14,300

D) $14,700

Correct Answer:

Verified

Q34: In February of the current year (assume

Q51: Hui pays self-employment tax on her sole

Q57: Peter is assessed $630 for street improvements

Q57: During the year Jason and Kristi,cash-basis taxpayers,paid

Q65: Wayne and Maria purchase a home on

Q65: Phuong has the following sources of investment

Q66: Investment interest expense is deductible

A)as an offset

Q67: Nina includes the following expenses in her

Q71: Christopher,a cash-basis taxpayer,borrows $1,000 from ABC Bank

Q77: Valeria owns a home worth $1,400,000,with a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents