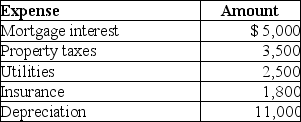

Mackensie owns a condominium in the Rocky Mountains.During the year,Mackensie uses the condo a total of 23 days.The condo is also rented to tourists for a total of 77 days and generates rental income of $10,900.Mackensie incurs the following expenses in the condo:

Using the court's method of allocating expenses,the amount of depreciation that Mackensie may take with respect to the rental property will be

A) $0.

B) $1,044.

C) $5,796.

D) $11,000

Correct Answer:

Verified

Q97: Victor,a calendar-year taxpayer,owns 100 shares of AB

Q104: Expenses attributable to the rental use of

Q105: Nikki is a single taxpayer who owns

Q106: Dana purchased an asset from her brother

Q115: Jason sells stock with an adjusted basis

Q118: Chana purchased 400 shares of Tronco Corporation

Q124: Lindsey Forbes,a detective who is single,operates a

Q126: During the current year,Paul,a single taxpayer,reported the

Q140: Kelsey enjoys making cupcakes as a hobby

Q486: Explain the rules for determining whether a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents