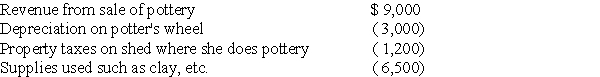

Lindsey Forbes,a detective who is single,operates a small pottery activity on a part-time basis.This year she reported the following income and expenses from this activity:

In addition,she had salary of $70,000 and itemized deductions,not including expenses listed above,of $6,800.

a. What is the amount of Lindsey's taxable income assuming the activity is classified as a hobby?

b. What is the amount of Lindsey's taxable income assuming the activity is classified as a trade or business?

Correct Answer:

Verified

Q104: Expenses attributable to the rental use of

Q105: Nikki is a single taxpayer who owns

Q106: Dana purchased an asset from her brother

Q121: Mackensie owns a condominium in the Rocky

Q125: Anita has decided to sell a parcel

Q126: During the current year,Paul,a single taxpayer,reported the

Q129: Ola owns a cottage at the beach.She

Q135: Abigail's hobby is sculpting.During the current year,Abigail

Q140: Kelsey enjoys making cupcakes as a hobby

Q486: Explain the rules for determining whether a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents