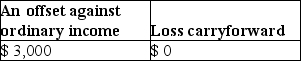

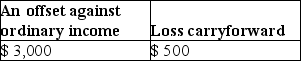

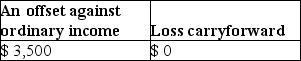

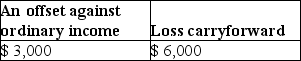

Gertie has a NSTCL of $9,000 and a NLTCG of $5,500 during the current taxable year.After gains and losses are offset,Gertie reports

A)

B)

C)

D)

Correct Answer:

Verified

Q88: Candice owns a mutual fund that reinvests

Q102: Topaz Corporation had the following income and

Q104: Jade is a single taxpayer in the

Q105: Trista,a taxpayer in the 33% marginal tax

Q106: During the current year,Nancy had the following

Q106: Unlike an individual taxpayer,the corporate taxpayer does

Q108: Tina,whose marginal tax rate is 33%,has the

Q110: Mike sold the following shares of stock

Q111: Kendrick,who has a 33% marginal tax rate,had

Q124: Everest Inc.is a corporation in the 35%

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents