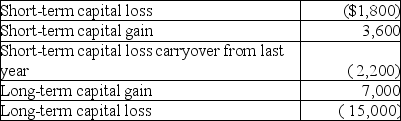

During the current year,Nancy had the following transactions:

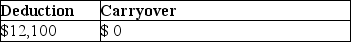

What is the amount of her capital loss deduction for the current year,and what is the amount and character of her capital loss carryover?

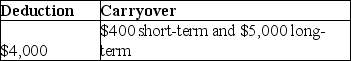

A)

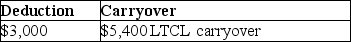

B)

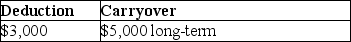

C)

D)

Correct Answer:

Verified

Q102: Topaz Corporation had the following income and

Q102: Olivia,a single taxpayer,has AGI of $280,000 which

Q104: Jade is a single taxpayer in the

Q105: Trista,a taxpayer in the 33% marginal tax

Q106: Unlike an individual taxpayer,the corporate taxpayer does

Q107: Gertie has a NSTCL of $9,000 and

Q108: Tina,whose marginal tax rate is 33%,has the

Q110: Mike sold the following shares of stock

Q111: Kendrick,who has a 33% marginal tax rate,had

Q124: Everest Inc.is a corporation in the 35%

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents