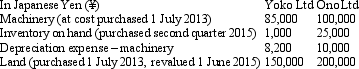

Lennon Ltd has two foreign operations based in Japan.The following information was extracted from the foreign operation's accounts for the period ended 30 June 2015:  Exchange rate information is:

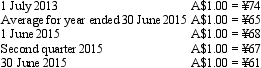

Exchange rate information is: The translation from Japanese Yen to Australian dollars resulted to the following balances (rounded to the nearest ¥000) :

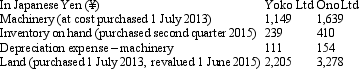

The translation from Japanese Yen to Australian dollars resulted to the following balances (rounded to the nearest ¥000) : Which of the following translation processes were applied to Yoko Ltd and Ono Ltd,respectively,for the year ended 30 June 2015?

Which of the following translation processes were applied to Yoko Ltd and Ono Ltd,respectively,for the year ended 30 June 2015?

A) Functional currency; Presentation currency;

B) Functional currency; Functional currency;

C) Presentation currency; Functional currency;

D) Presentation currency; Presentation currency;

E) None of the given answers.

Correct Answer:

Verified

Q31: As prescribed in AASB 121,when re-measuring financial

Q32: Yarra Manufacturing Ltd is an Australian registered

Q33: In the process of consolidating the translated

Q34: Under the translation method required by AASB

Q35: The following is an extract from the

Q36: If the assets of a foreign operation

Q37: Distributions from retained profits are translated at

A)

Q38: Aus Co Ltd has a foreign operation

Q39: As prescribed in AASB 121,when re-measuring financial

Q40: Aus Co Ltd has a foreign operation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents