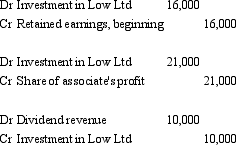

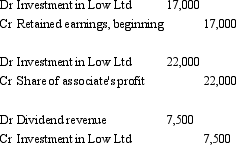

Jay Ltd acquired a 25 per cent interest in Low Ltd on 1 July 2003 for a cash consideration of $177,500.Low Ltd's equity at the time of purchase was as follows:  Additional information:

Additional information:

On 1 July 2003 Low's plant and equipment had a carrying value of $120,000 but a fair value of $140,000.The remaining expected useful life of the plant and equipment at this date was 10 years.Low did not revalue the plant and equipment in its books.

For the period ending 30 June 2004 Low Ltd recorded an after-tax profit of $70,000 out of which dividends of $30,000 were proposed in the 2003/2004 period and paid in the 2004/2005 period.

For the year ended 30 June 2005 Low Ltd had an after-tax profit of $90,000 out of which it provided for a dividend of $40,000,which has not been paid.

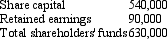

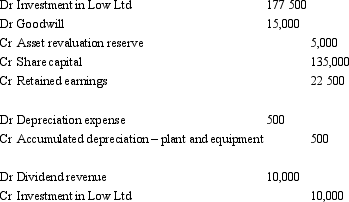

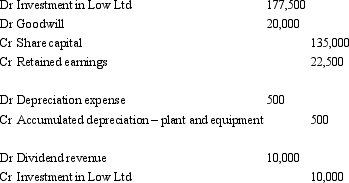

Jay Ltd does not accrue the dividends of associates as revenue when they are proposed.The investment has been recorded in Jay's books in accordance with the cost method.What consolidation journal entries are required to apply the equity accounting method for the period ended 30 June 2005?

A)

B)

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Q37: Under the cost method of accounting for

Q38: In the case of non-current investments in

Q39: Equity investments include:

A) Unsecured notes.

B) Trust units.

C)

Q40: Firms may make long-term investments in the

Q41: AASB 132 includes in its definition of

Q43: Eagle Ltd is the ultimate parent entity

Q44: When equity accounting is applied,how is the

Q45: Derivative instruments are instruments that:

A) derive their

Q46: Quartermain Limited has the following investments: Christian

Q47: Flower Ltd acquired a 35 per cent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents