Eagle Ltd is the ultimate parent entity in a group of companies.On 1 July 2003 Eagle Ltd acquired 30 per cent of the issued capital of Sparrow Ltd for a cash consideration of $366,000.At the date of acquisition the net assets of Sparrow Ltd are recorded at fair value and are represented by equity as follows:  Additional information:

Additional information:

During the financial year ending 30 June 2004 Sparrow Ltd makes a profit before tax of $140,000,and an after-tax profit of $89,000.

Sparrow Ltd proposed a dividend of $20,000 for the 2003/2004 period that will be paid early in the next period.

Eagle Ltd does not recognise dividends proposed by associates until they are paid.

During the year ended 30 June 2004 Sparrow made intragroup sales to members of Eagle's economic group.These include:

Sparrow sold inventory to Peregrin Ltd,an 80 per cent owned subsidiary of Eagle Ltd.The inventory cost Sparrow $8,000 and was sold to Peregrin for $12,000.Half of that inventory is still on hand in Peregrin at the end of the period.

Sparrow sold inventory to Seagull Ltd,a 25 per cent owned associate of Eagle's.The inventory cost Sparrow $10,000 and was sold to Seagull for $15,000.Forty per cent of this inventory is still on hand in Seagull at the end of the period.

The tax rate is 30 per cent.

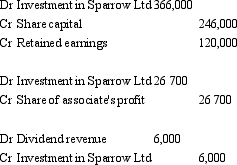

What consolidated journal entry/ies is/are required to equity account for Eagle's interest in Sparrow Ltd for the period ended 30 June 2004?

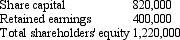

A)

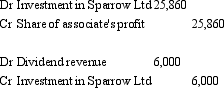

B)

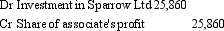

C)

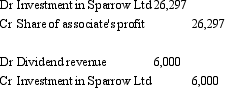

D)

E) None of the given answers.

Correct Answer:

Verified

Q38: In the case of non-current investments in

Q39: Equity investments include:

A) Unsecured notes.

B) Trust units.

C)

Q40: Firms may make long-term investments in the

Q41: AASB 132 includes in its definition of

Q42: Jay Ltd acquired a 25 per cent

Q44: When equity accounting is applied,how is the

Q45: Derivative instruments are instruments that:

A) derive their

Q46: Quartermain Limited has the following investments: Christian

Q47: Flower Ltd acquired a 35 per cent

Q48: AASB 128 notes that in the absence

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents