On 1 July 2012,Goliath Ltd acquires all shares in David Ltd for $800 000.The fair value of net assets acquired is $920 000 comprised of $600,000 in share capital and $320 000 in retained earnings.What is the appropriate elimination entry for this investment that is in accordance with AASB 3 "Business Combinations" and AASB 127 "Consolidated and Separate Financial Statements"?

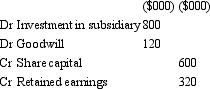

A)

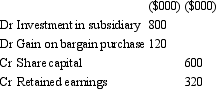

B)

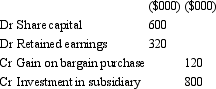

C)

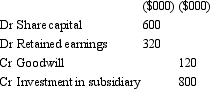

D)

E) None of the given answers.

Correct Answer:

Verified

Q59: In determining control,'potential voting rights':

A) include those

Q60: Fresco Ltd acquires all the issued capital

Q61: When group members do not apply the

Q62: Which of the following statements is not

Q63: Which of the following statements is not

Q64: Which of the following statements about post-acquisition

Q65: On 1 July 2012,Felix Ltd acquires all

Q66: On consolidation,the investment in subsidiary,shown in the

Q67: On 1 July 2012,Carol Ltd acquires all

Q68: On 1 July 2012,Bob Ltd acquires all

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents