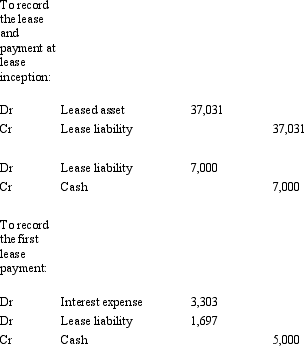

Hoof & Tail Ltd enters into a non-cancellable lease agreement with Equine Industries to lease some equipment under the following conditions:  The interest rate implicit in the lease is 11 per cent and the fair value of the asset at the inception of the lease is $37 031.What are the journal entries to record the lease,the payment at lease inception and the first lease payment in the books of the lessee (rounded to the nearest dollar) ?

The interest rate implicit in the lease is 11 per cent and the fair value of the asset at the inception of the lease is $37 031.What are the journal entries to record the lease,the payment at lease inception and the first lease payment in the books of the lessee (rounded to the nearest dollar) ?

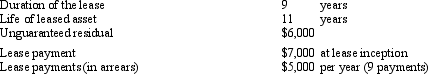

A)

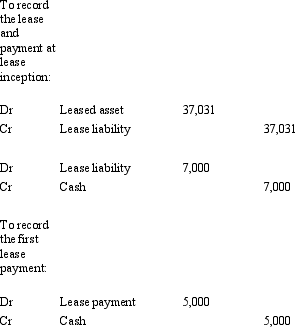

B)

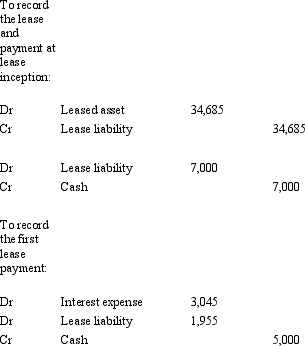

C)

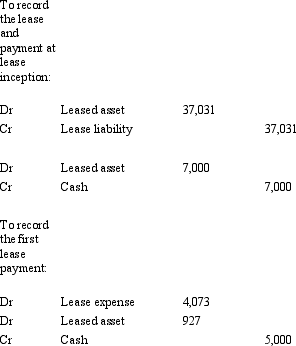

D)

E) None of the given answers.

Correct Answer:

Verified

Q55: Cobalt Ltd owns an item of machinery

Q56: Where a lessor is involved in a

Q57: Mitchum Ltd entered into a lease agreement

Q58: A sale and leaseback arrangement may involve

Q59: Joplin Ltd entered into a lease agreement

Q61: Lease incentives are.

A) Not covered by AASB

Q62: The following journal entry,in the books of

Q63: The following is an extract from a

Q64: On 1 January 2012 Dobel Ltd signed

Q65: Alpine Ltd signed a 10-year non-cancellable lease

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents