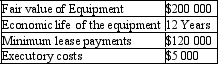

Alpine Ltd signed a 10-year non-cancellable lease with Mt Buller Ltd for the use of high-tech equipment.No bargain purchase option is provided in the lease contract. The following information is available. What is the amount to be recorded as an asset and a liability in the books of the lessee that is in accordance with AASB 117 "Leases"?

What is the amount to be recorded as an asset and a liability in the books of the lessee that is in accordance with AASB 117 "Leases"?

A) $0;

B) $120 000;

C) $125 000;

D) $200 000;

E) None of the given answers

Correct Answer:

Verified

Q1: In a lease arrangement that is classified

Q60: Hoof & Tail Ltd enters into a

Q61: Lease incentives are.

A) Not covered by AASB

Q62: The following journal entry,in the books of

Q63: The following is an extract from a

Q64: On 1 January 2012 Dobel Ltd signed

Q66: For a lessee entering into a finance

Q67: Paragraph 47 of AASB 117 requires that

Q68: For a depreciable asset,the amount of depreciation

Q69: From the perspective of the lessor,finance leases

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents