Fast Movers Ltd purchased a machine on the first day of their financial year: 1 January 2002.The machine cost $75 000 and has an expected useful life of 10 years at which time its salvage value will be $8000.An even pattern of benefits is expected to be derived from the machine.Then on 31 December 2005 (3 years later) the machine is sold for $65 000.What are the appropriate journal entries to record the disposal of the machine in line with the requirements of AASB 116?

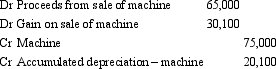

A)

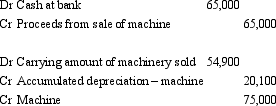

B)

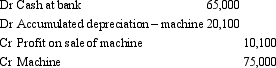

C)

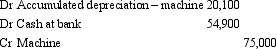

D)

E) None of the given answers.

Correct Answer:

Verified

Q23: Tantrax Ltd has just purchased a piece

Q24: Hugo Ltd has acquired a machine for

Q25: When selecting a method of cost apportionment

Q26: Forwind Ltd has recently acquired a machine

Q27: Profit on the sale of an asset

Q29: The useful life of an asset may

Q30: Assets should be depreciated from:

A) The date

Q31: Pentec Ltd has just acquired 5 new

Q32: AASB 116 requires that depreciation be reviewed

A)

Q33: Cutting Edge Ltd purchased a state of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents