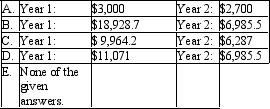

Pentec Ltd has just acquired 5 new computers for $29,000 in total and paid a further $1,000 to have additional zip drives added.The computers are expected to have a useful life of 5 years and its salvage value is expected to be $3,000.Pentec Ltd has decided to apply the declining balance method of calculating depreciation.What is the first 2 years depreciation charge on the computers?

Correct Answer:

Verified

Q26: Forwind Ltd has recently acquired a machine

Q27: Profit on the sale of an asset

Q28: Fast Movers Ltd purchased a machine on

Q29: The useful life of an asset may

Q30: Assets should be depreciated from:

A) The date

Q32: AASB 116 requires that depreciation be reviewed

A)

Q33: Cutting Edge Ltd purchased a state of

Q34: Yellow Limited purchased an asset 6 years

Q35: Super Industries purchased a new vehicle on

Q36: Red Enterprises purchased a vehicle for $35

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents