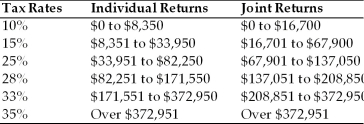

Table 1.4

Use the following tax rates and income brackets to answer the following question(s) .

-John and Nicole earn a combined taxable income of $148,800 from employment and file a joint tax return.If they earn$1,000 in short-term capital gains, how much will they owe on those gains?

A) $100

B) $150

C) $250

D) $280

Correct Answer:

Verified

Q49: Table 1.4

Use the following tax rates and

Q51: Danielle and Jonathan are in the 28%

Q52: Which of the following economic conditions is

Q53: Wages, tips, pension income and alimony are

Q57: Monitoring and restructuring your investments is called

A)

Q59: You should spend money on housing, clothing

Q62: Discuss the relationship between stock prices and

Q68: Liquidity is the ability to convert an

Q70: U.S. Treasury Bills mature in 1 year

Q74: Discuss the general investment philosophy and the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents