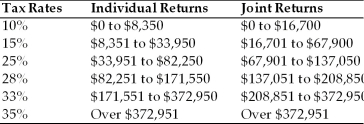

Table 1.4

Use the following tax rates and income brackets to answer the following question(s) .

-Josh earned $89,700 in taxable income and files an individual tax return.What is the amount of Josh's taxes for the year?

A) $16,750

B) $18,836

C) $22,425

D) $25,116

Correct Answer:

Verified

Q44: Andrew and Jennifer are in the 25%

Q46: For a taxpayer in the 25% marginal

Q47: Which one of the following statements about

Q51: Danielle and Jonathan are in the 28%

Q52: Which of the following economic conditions is

Q53: Table 1.4

Use the following tax rates and

Q60: Under current tax law, dividend income is

Q68: Liquidity is the ability to convert an

Q70: U.S. Treasury Bills mature in 1 year

Q74: Discuss the general investment philosophy and the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents