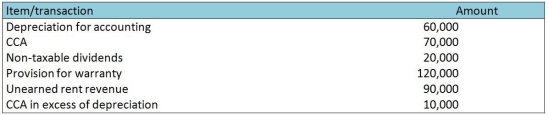

For each of the following differences between the amount of taxable income and income recorded for financial reporting purposes,compute the effect of each difference on deferred taxes balances on the balance sheet.Treat each item independently of the others.Assume a tax rate of 25%.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q46: Which is correct regarding the effect of

Q67: Under the accrual method,what is the effect

Q68: The following information relates to the accounting

Q69: How much tax expense would be recorded

Q70: In 2017,Harry,Burly and Toe Co.sells its single

Q71: The following summarizes information relating to Crockodile

Q73: Under the accrual method,what is the effect

Q74: How much tax expense would be recorded

Q75: How much tax expense would be recorded

Q76: Under the accrual method,what is the tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents