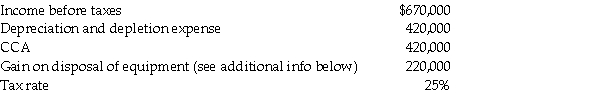

The following information relates to the accounting income for Saskatchewan Real Estate Company (SREC)for the current year ended December 31.

During the year,the company sold one of its buildings with carrying value of $780,000 for proceeds of $1,000,000,resulting in an accounting gain of $220,000.This gain has been included in the pre-tax income figure of $670,000 shown above.For tax purposes,the acquisition cost of the building was $870,000.For purposes of CCA,it is a Class 1 Asset,which treats each building as a separate class.The undepreciated capital cost (UCC)on the building at the time of disposal was $660,000.

During the year,the company sold one of its buildings with carrying value of $780,000 for proceeds of $1,000,000,resulting in an accounting gain of $220,000.This gain has been included in the pre-tax income figure of $670,000 shown above.For tax purposes,the acquisition cost of the building was $870,000.For purposes of CCA,it is a Class 1 Asset,which treats each building as a separate class.The undepreciated capital cost (UCC)on the building at the time of disposal was $660,000.

Required:

Prepare the journal entries to record income taxes for SREC.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q63: The following summarizes information relating to Gonzalez

Q64: The following data represent the differences between

Q65: Under the accrual method,what is the effect

Q66: What is the opening balance of the

Q67: Under the accrual method,what is the effect

Q69: How much tax expense would be recorded

Q70: In 2017,Harry,Burly and Toe Co.sells its single

Q71: The following summarizes information relating to Crockodile

Q72: For each of the following differences between

Q73: Under the accrual method,what is the effect

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents