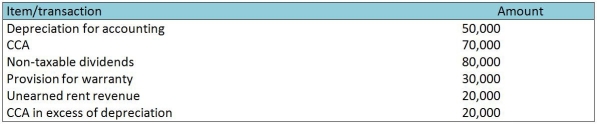

For each of the following differences between the amount of taxable income and income recorded for financial reporting purposes,compute the effect of each difference on deferred taxes balances on the balance sheet.Treat each item independently of the others.Assume a tax rate of 30%.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q22: Which statement is correct?

A)Undepreciated capital cost (UCC)is

Q43: When will a terminal loss occur?

A)When proceeds

Q59: Indicate whether the item will result in

Q60: When will there be recapture and a

Q61: The following information relates to the accounting

Q63: The following summarizes information relating to Gonzalez

Q64: The following data represent the differences between

Q65: Under the accrual method,what is the effect

Q66: What is the opening balance of the

Q67: Under the accrual method,what is the effect

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents