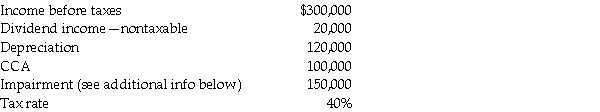

The following information relates to the accounting income for Withering Press Company (WPC)for the current year ended December 31.

The company had purchased land some years ago for $600,000.Recently,it was discovered that this land is contaminated by industrial pollution.Because of the soil remediation costs required,the value of the land has decreased.For tax purposes,the impairment loss is not currently deductible.In the future when the land is sold,half of any losses is deductible against taxable capital gains (ie.,the other half that is not taxable or deductible is a permanent difference).

The company had purchased land some years ago for $600,000.Recently,it was discovered that this land is contaminated by industrial pollution.Because of the soil remediation costs required,the value of the land has decreased.For tax purposes,the impairment loss is not currently deductible.In the future when the land is sold,half of any losses is deductible against taxable capital gains (ie.,the other half that is not taxable or deductible is a permanent difference).

The deferred income tax liability account on January 1 had a credit balance of $45,000.This balance is entirely related to property,plant,and equipment (PPE).

Required:

Prepare the journal entries to record income taxes for WPC.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q22: Which statement is correct?

A)Undepreciated capital cost (UCC)is

Q43: When will a terminal loss occur?

A)When proceeds

Q47: When will there be a recapture of

Q59: Indicate whether the item will result in

Q60: When will there be recapture and a

Q62: For each of the following differences between

Q63: The following summarizes information relating to Gonzalez

Q64: The following data represent the differences between

Q65: Under the accrual method,what is the effect

Q66: What is the opening balance of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents