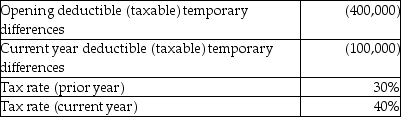

What adjustment is required to the opening deferred taxes as a result of the rate change?

A) 40,000 debit

B) 40,000 credit

C) 130,000 credit

D) 190,000 credit

Correct Answer:

Verified

Q41: Which statement is correct?

A)The income tax system

Q42: A company has a deferred tax liability

Q44: A company has a deferred tax liability

Q59: A company has a deferred tax liability

Q64: Which statement is true?

A)IAS 12 states the

Q74: In the first two years of operations,

Q87: What is the opening balance of the

Q89: A company had taxable income of $12

Q93: What adjustment is required to the opening

Q96: What is the ending balance of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents