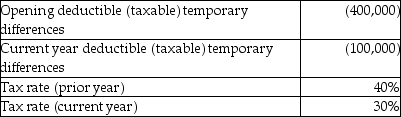

What adjustment is required to the opening deferred taxes as a result of the rate change?

A) 30,000 credit

B) 90,000 credit

C) 40,000 credit

D) 40,000 debit

Correct Answer:

Verified

Q41: Which statement is correct?

A)The income tax system

Q42: A company has a deferred tax liability

Q44: A company has a deferred tax liability

Q59: A company has a deferred tax liability

Q64: Which statement is true?

A)IAS 12 states the

Q74: In the first two years of operations,

Q89: A company had taxable income of $12

Q92: What adjustment is required to the opening

Q96: What is the ending balance of the

Q98: A company had taxable income of $2

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents