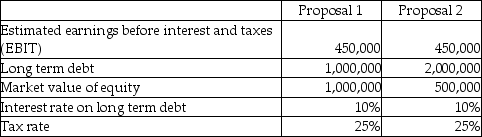

Blue Corp is in the process of acquiring another business.In light of the acquisition,shareholders are currently re-evaluating the appropriateness of the firm's capital structure (the types of and relative levels of debt and equity).The two proposals being contemplated are detailed below:

Required:

Required:

a.Calculate the estimated return on equity (ROE)under the two proposals.(ROE = net income after taxes / market value of equity; net income after taxes = (EBIT - interest on long-term debt)× (1 - tax rate)).

b.Which proposal will generate the higher estimated ROE?

c.What is the primary benefit of leveraging an investment decision? What are two drawbacks to leveraging an investment decision?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: What is a "covenant"?

A)Guarantee of the price

Q14: What is a bond indenture?

A)Guarantee of the

Q15: Sally has to decide between the following

Q17: Sally has to decide between the following

Q18: Fast Track Inc.is in the process of

Q20: Which statement is correct about the financial

Q23: Contrast the two methods used by investment

Q28: What does an "AAA" credit rating mean?

Q32: What is meant by the "spread" charged

Q35: Why are banks able to pay such

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents