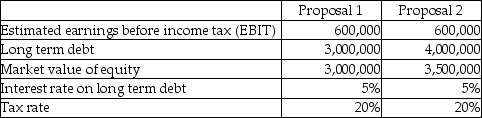

Fast Track Inc.is in the process of acquiring another business.In light of the acquisition,shareholders are currently re-evaluating the appropriateness of the firm's capital structure (the types of and relative levels of debt and equity).The two proposals being contemplated are detailed below:

Required:

Required:

a.Calculate the estimated return on equity (ROE)under the two proposals.(ROE = net income after taxes / market value of equity; net income after taxes = (EBIT - interest on long-term debt)× (1 - tax rate)).

b.Which proposal will generate the higher estimated ROE?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: What is a "covenant"?

A)Guarantee of the price

Q12: Which of the following would be a

Q14: What is a bond indenture?

A)Guarantee of the

Q15: Sally has to decide between the following

Q17: Sally has to decide between the following

Q18: Why do bonds often include covenants?

A)To reduce

Q20: Which statement is correct about the financial

Q20: Blue Corp is in the process of

Q23: Contrast the two methods used by investment

Q32: What is meant by the "spread" charged

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents