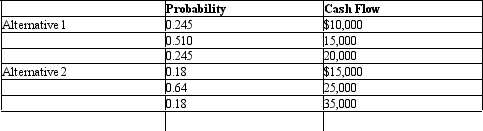

Probability Analysis. The Medical Centre is considering taking on a new lease for additional office space in alternative suburban shopping areas. Alternative 1 requires a current investment outlay of $50,000; alternative 2 requires an outlay of $75,000. The following cash flows will be generated each year over an initial five-year lease period.

A. Calculate the expected cash flow for each investment alternative.

A. Calculate the expected cash flow for each investment alternative.

B. Calculate the standard deviation and coefficient of variation of cash flows (risk) for each investment alternative.

C. The firm will use a discount rate of 15% for the cash flows with higher degree of dispersion and a 12% rate for the less risky cash flows, calculate the expected net present value for each investment. Which alternative should be chosen?

Correct Answer:

Verified

C. Alternative 2 is ris...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q18: The maximin criterion involves:

A) minimization of expected

Q19: Economic risk is a situation where:

A) only

Q20: The minimum expected opportunity loss associated with

Q21: The amount of a bet is irrational

Q22: Standard Normal. A leading company in the

Q24: Uncertainty is present when:

A) outcomes are unknown.

B)

Q25: Certainty Equivalents. Rajun Cajun's, Ltd., is a

Q26: Probability Analysis. WD-50, Inc. has just completed

Q27: Risk Attitudes. Identify each of the following

Q28: Expected Return Analysis. Barry Bonds offers free

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents