Competitive Strategy. Carry Underwood runs Tax Preparation Services, Inc., a small firm that offers timely tax preparation services in Oklahoma City. Given the large number of competitors, the fact that tax preparers rely heavily upon standard tax-preparation software, and the lack of entry barriers, it is reasonable to assume that the tax form preparation market is perfectly competitive and that the average $150 price equals marginal revenue, P = MR = $150. Assume that TPS's annual operating expenses are typical of several such firms operating in the local market, and can be expressed by the following total and marginal cost functions:

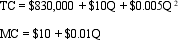

where TC is total cost per year, MC is marginal cost, and Q is the number of clients served. Total costs include a normal profit and allow for Underwood's employment opportunity costs.

where TC is total cost per year, MC is marginal cost, and Q is the number of clients served. Total costs include a normal profit and allow for Underwood's employment opportunity costs.

Correct Answer:

Verified

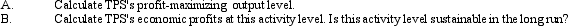

The Q = 14,000 activity level r...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q40: Social Welfare Concepts. Indicate whether each of

Q41: Competitive Strategy. Bob Ice owns and operates

Q42: Compulsory Benefit Costs. The Telemarketing Louisianan Company

Q43: Costs of Regulation. The Appalachian Coal Company

Q44: Outsourcing Tariffs. The Seattle Software Company develops,

Q45: Regulation Costs. Finlandia, Inc., manufacturers molded plastic

Q46: Regulation Costs. Ottawa Construction, Ltd., is a

Q47: Price Floors and Consumer Surplus. The U.

Q49: Price Floors and Producer Surplus. The U.

Q50: Tariffs. The Manchester Shoe Corporation is an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents