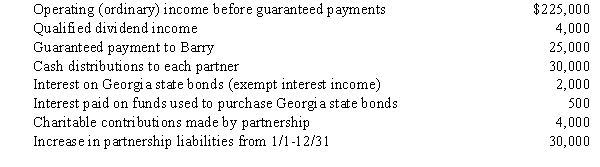

An examination of the RB Partnership's tax books provides the following information for the current year:

Barry is a 30% partner in partnership capital,profits,and losses.Assume the adjusted basis of his partnership interest is $50,000 at the beginning of the year,and he shares in 30% of the partnership liabilities for basis purposes.

a.What is Barry's adjusted basis for the partnership interest at the end of the year?

b.How much income must Barry report on his tax return for the current year? What is the character of income?

Correct Answer:

Verified

b.Barry will report $60,000 of income ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q63: Eric contributes property with a fair market

Q67: Joel and Desmond are forming the JD

Q68: The STU Partnership is involved in leasing

Q96: Harry and Sally are considering forming a

Q128: Match each of the following statements with

Q151: Susan and Sarah form a partnership by

Q159: Match each of the following statements with

Q166: The MOG Partnership reports ordinary income of

Q190: Match each of the following statements with

Q191: Match each of the following statements with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents