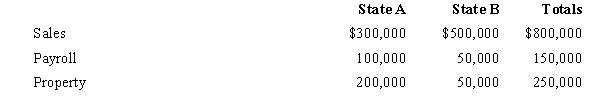

Boot Corporation is subject to income tax in States A and B.Boot's operations generated $1,200,000 of apportionable income,and its sales and payroll activity and average property owned in each of the states is as follows.

How much more (less) of Boot's income is subject to A income tax if,instead of using an equally-weighted three-factor apportionment formula,A uses a formula with a double-weighted sales factor?

A) ($450,000) .

B) ($71,640) .

C) $71,640.

D) $450,000.

Correct Answer:

Verified

Q45: Under most local property tax laws,the value

Q61: Fowl Corporation's entire operations are located in

Q62: Bert Corporation,a calendar-year taxpayer,owns property in States

Q63: In the broadest application of the unitary

Q64: Trayne Corporation's sales office and manufacturing plant

Q66: State A applies a throwback rule.General Corporation

Q67: Corolla Corporation owns manufacturing facilities in States

Q68: A taxpayer wishing to reduce the negative

Q69: State D has adopted the principles of

Q70: ![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents