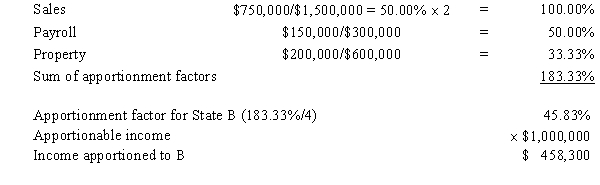

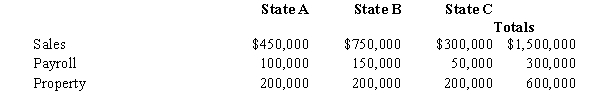

-Tripp Corporation owns manufacturing facilities in States A,B,and C.A uses a three-factor apportionment formula under which the sales,property and payroll factors are equally weighted.B uses a three-factor apportionment formula under which sales are double-weighted.C employs a single-factor apportionment factor,based solely on sales.

Tripp's operations generated $1,000,000 of apportionable income,and its sales and payroll activity and average property owned in each of the three states is as follows.

Tripp's apportionable income assigned to C is:

A) $1,000,000.

B) $430,542.

C) $333,333.

D) $200,000.

E) $0.

Correct Answer:

Verified

Q41: The throwback rule requires that:

A)Sales of services

Q65: Boot Corporation is subject to income tax

Q66: State A applies a throwback rule.General Corporation

Q67: Corolla Corporation owns manufacturing facilities in States

Q68: A taxpayer wishing to reduce the negative

Q69: State D has adopted the principles of

Q71: State A does not apply a throwback

Q73: Valdez Corporation,a calendar-year taxpayer,owns property in States

Q74: When the taxpayer has exposure to a

Q75: Net Corporation's sales office and manufacturing plant

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents