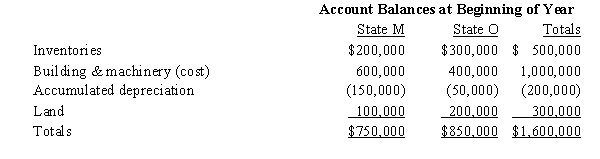

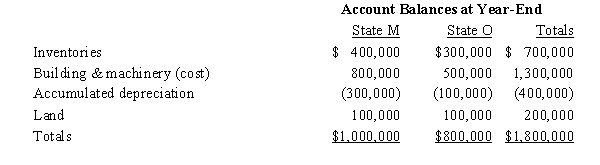

Valdez Corporation,a calendar-year taxpayer,owns property in States M and O.Both M and O require that the average value of assets be included in the property factor.M requires that the property be valued at its historical cost,and O requires that the property be included in the property factor at its net depreciated book value.

Valdez's property factor for State O is:

A) 41.25%.

B) 44.44%.

C) 45.0%.

D) 48.53%.

E) 51.47%.

Correct Answer:

Verified

Q41: The throwback rule requires that:

A)Sales of services

Q68: A taxpayer wishing to reduce the negative

Q69: State D has adopted the principles of

Q70: Q71: State A does not apply a throwback Q74: When the taxpayer has exposure to a Q75: Net Corporation's sales office and manufacturing plant Q76: State B applies a throwback rule,but State Q77: Helene Corporation owns manufacturing facilities in States Q78: Peete Corporation is subject to franchise tax![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents