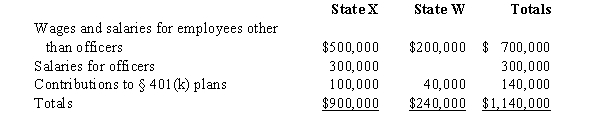

Net Corporation's sales office and manufacturing plant are located in State X.Net also maintains a manufacturing plant and sales office in State W.For purposes of apportionment,X defines payroll as all compensation paid to employees,including contributions to § 401(k) deferred compensation plans.Under the statutes of W,neither compensation paid to officers nor contributions to § 401(k) plans are included in the payroll factor.Net incurred the following personnel costs.

Net's payroll factor for State W is:

A) 0%.

B) 21.05%.

C) 28.57%.

D) 50.00%.

Correct Answer:

Verified

Q41: The throwback rule requires that:

A)Sales of services

Q70: Q71: State A does not apply a throwback Q73: Valdez Corporation,a calendar-year taxpayer,owns property in States Q74: When the taxpayer has exposure to a Q76: State B applies a throwback rule,but State Q77: Helene Corporation owns manufacturing facilities in States Q78: Peete Corporation is subject to franchise tax Q79: State A applies a throwback rule,but State Q80: Judy,a regional sales manager,has her office in![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents