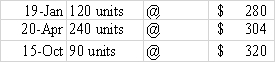

Max Company's first year in operation was 2016.The following inventory purchase information comes from Max's accounting records for the year.

In December 2016,Max sold 350 units for $480 each.Operating expenses for the year were $30,000,and the tax rate was 30%.

Required: a)Calculate the cost of goods sold by LIFO and by FIFO.

b)What amount of income tax would Max have to pay if it uses LIFO? If it uses FIFO?

c)Assuming that the results for 2016 are representative of what Max can generally expect,would you recommend that the company use LIFO or FIFO? Explain.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q124: The Rowe Company has six different categories

Q125: The Byrne Company had its entire inventory

Q126: Curtis Company had the following transactions for

Q127: The following information is for Choi Company

Q128: Maynard Company started the year with no

Q130: Burton Supply uses the perpetual inventory method.At

Q131: The accountant for the Bay Company made

Q132: The following information is for Benitez Company

Q133: The Curtis Company's inventory records reflects the

Q134: The following information is for Poole Company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents