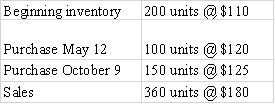

The following information is for Poole Company for 2016:

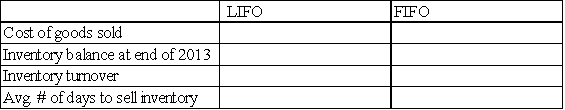

Required: a)Assuming that Poole uses the LIFO cost flow method,determine how much product cost would be allocated to Cost of Goods Sold,and how much to Merchandise Inventory at the end of the year.

b)Based on your results from part a,calculate inventory turnover and average number of days to sell inventory.

c)Assuming that Poole uses the FIFO cost flow method,determine how much product cost would be allocated to Cost of Goods sold,and how much to Merchandise Inventory at the end of the year.

d)Based on your results from part c,calculate inventory turnover and average number of days to sell inventory.

e)Compare your results from parts b and d.Do LIFO and FIFO give the same results for inventory turnover? Which is higher,and why?

Correct Answer:

Verified

e)LIFO and FIFO do not give the s...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q124: The Rowe Company has six different categories

Q125: The Byrne Company had its entire inventory

Q126: Curtis Company had the following transactions for

Q127: The following information is for Choi Company

Q128: Maynard Company started the year with no

Q129: Max Company's first year in operation was

Q130: Burton Supply uses the perpetual inventory method.At

Q131: The accountant for the Bay Company made

Q132: The following information is for Benitez Company

Q133: The Curtis Company's inventory records reflects the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents