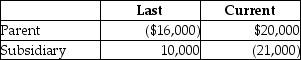

Parent and Subsidiary Corporations form an affiliated group.Last year,the initial year of operation,Parent and Subsidiary filed separate returns.This year.the group files a consolidated return.

Taxable Income

How much of the Subsidiary loss can be carried back to last year?

A) $0

B) $1,000

C) $10,000

D) none of the above

Correct Answer:

Verified

Q63: Mako and Snufco Corporations are affiliated and

Q67: The Alto-Baxter affiliated group filed a consolidated

Q70: Parent and Subsidiary Corporations are members of

Q70: Boxcar Corporation and Sidecar Corporation,an affiliated group,reports

Q71: Identify which of the following statements is

Q72: Parent and Subsidiary Corporations form an affiliated

Q73: Blair and Cannon Corporations are members of

Q80: How do intercompany transactions affect the calculation

Q83: Identify which of the following statements is

Q98: Identify which of the following statements is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents