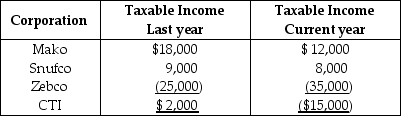

Mako and Snufco Corporations are affiliated and have filed consolidated returns for the past three years.Mako acquired 100% of Zebco stock on January 1 of last year,the date of Zebco's formation.Mako,Snufco,and Zebco,who have filed consolidated returns for last year and the current year,report the following taxable incomes.

The $15,000 consolidated NOL reported in the current year

A) cannot be carried back.

B) can be carried back three years ago only.

C) can be carried back to last year and the remainder,if any,carried forward to subsequent years.

D) can only be used in future years.

Correct Answer:

Verified

Q51: Identify which of the following statements is

Q54: Identify which of the following statements is

Q58: Which of the following statements is true?

A)A

Q64: Jason and Jon Corporations are members of

Q67: The Alto-Baxter affiliated group filed a consolidated

Q68: Parent and Subsidiary Corporations form an affiliated

Q70: Parent and Subsidiary Corporations are members of

Q75: Alpha,Beta,Gamma,and Delta Corporations form a controlled group.Delta

Q80: How do intercompany transactions affect the calculation

Q83: Identify which of the following statements is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents