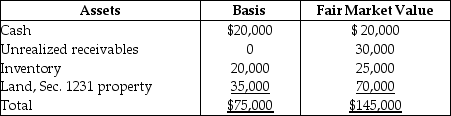

The Tandy Partnership owns the following assets on December 31:

Is the partnership's inventory considered to be substantially appreciated for purposes of Sec.751? Show your work.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q45: Identify which of the following statements is

Q51: Ed receives a $20,000 cash distribution from

Q54: Identify which of the following statements is

Q54: Before receiving a liquidating distribution,Kathy's basis in

Q55: Kenya sells her 20% partnership interest having

Q59: Identify which of the following statements is

Q62: Tony sells his one-fourth interest in the

Q63: On December 31,Kate receives a $28,000 liquidating

Q68: What is the character of the gain/loss

Q70: If a partnership chooses to form an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents