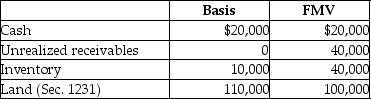

Kenya sells her 20% partnership interest having a $28,000 basis to Ebony for $40,000 cash.At the time of the sale,the partnership has no liabilities and its assets are as follows:

Kenya and Ebony have no agreement concerning the allocation of the sales price.Ordinary income recognized by Kenya as a result of the sale is

A) $6,000.

B) $12,000.

C) $14,000.

D) $16,000.

Correct Answer:

Verified

Q45: Identify which of the following statements is

Q46: The sale of a partnership interest always

Q49: A partner's holding period for a partnership

Q51: Ed receives a $20,000 cash distribution from

Q54: Before receiving a liquidating distribution,Kathy's basis in

Q54: Identify which of the following statements is

Q57: A partner can recognize gain, but not

Q59: Identify which of the following statements is

Q59: The Tandy Partnership owns the following assets

Q60: Adnan had an adjusted basis of $11,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents