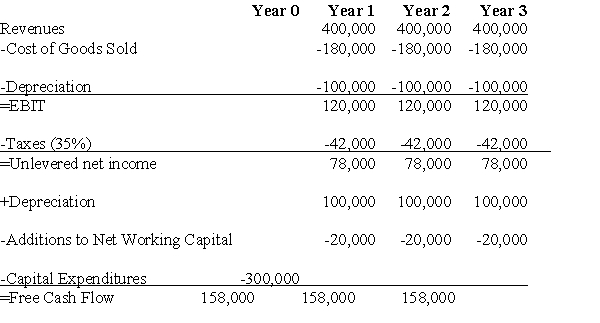

Use the table for the question(s) below.

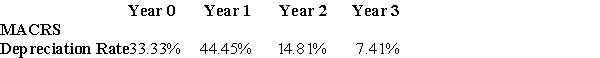

-Visby Rides,a livery car company,is considering buying some new luxury cars.After extensive research,they come up with the above estimates of free cash flow from this project.The depreciation schedule shown is for three-year,straight-line depreciation.By how much would the net present value (NPV) of this project be increased,if the cars were depreciated by the MACRS schedule shown below given that the cost of capital is 10%?

A) $8,342

B) $9,083

C) $10,112

D) $25,912

Correct Answer:

Verified

Q57: Use the information for the question(s)below.

Epiphany Industries

Q58: Your firm is considering building a new

Q60: Use the table for the question(s)below.

Q61: An announcement by the government that they

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents