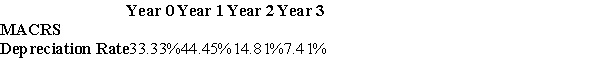

A firm is considering the purchase of a new machine for $300,000.The firm is unsure if it should use the 3-Year MACRS schedule or straightline depcreciation over three years.What is the difference in the book value after three years if the firm uses MACRS instead of straightline depreciation?

A) $0

B) $7,410

C) $14,820

D) $66,660

Correct Answer:

Verified

Q57: Use the information for the question(s)below.

Epiphany Industries

Q57: A company buys tracking software for its

Q58: Your firm is considering building a new

Q60: Use the table for the question(s)below.

Q61: An announcement by the government that they

Q63: Use the table for the question(s)below.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents