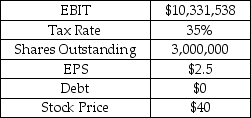

You are a buy-side analyst researching the Gorilla Glass Co.Gorilla plans to borrow $11 million by issuing bonds with an annual coupon of 7% and a yield to maturity of 7%.Gorilla will use the borrowed money to repurchase shares on the open market at $40 per share.You have gathered the information,shown in the table,regarding the company prior to the repurchase.You estimate that EBIT for Year 1 will be the same as reported for Year 0.Assume that the money is borrowed and the repurchase is executed at the beginning of Year 1.

Gorilla Glass Co.

Dec 31,Year 0

What is the Year 1 EPS?

A) $2.00

B) $2.28

C) $2.80

D) $3.25

E) $3.52

Correct Answer:

Verified

Q18: Random Dating Corp.operates a number of online

Q19: Kelly Varnsen,a junior financial analyst at Vandalay

Q20: The Pawtucket Brewery uses the residual dividend

Q21: Some investors think that Prestige Entertainment's repurchase

Q22: Smith Motors Inc.manufactures,distributes,and services automotive parts and

Q24: Acme Explosives Inc.is an international producer of

Q25: Ewing Oil repurchased $5.10B worth of shares

Q26: Cash-2-Day currently trades for $13.Analysts regard it

Q27: Cash-2-Day Company currently trades for $20.Analysts regard

Q28: Tarbox Tobacco Inc.is an all equity company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents