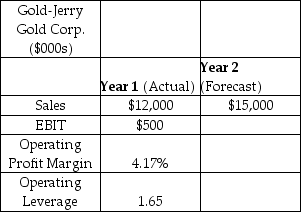

Gold-Jerry Gold Corporation is a mid-tier gold producer listed on the New York Stock Exchange.It is currently the end of Year 1,and the fiscal situation in the U.S and Europe is dire.Kenny Bania,an analyst at Gold-Jerry,forecasts that gold prices will rise during Year 2,since gold is regarded as a safe investment haven during periods of economic uncertainty.Bania is forecasting that Gold-Jerry's revenues will increase by 25% in Year 2.Use the data in the table to estimate Gold-Jerry's operating profit margin (EBIT/Sales) for Year 2.

A) 4.17%

B) 12.56%

C) 4.71%

D) 41.25%

E) 5.21%

Correct Answer:

Verified

Q2: The degree of operating leverage varies with

Q3: If EBIT increases 15%,EPS increases by 30%,debt

Q4: Jerry's Dog Food,Inc.is a dog food wholesaler

Q5: If sales increase 25%,EBIT increases 50%,debt increases

Q6: Which of the following statements is true?

A)

Q7: A 20% increase in sales causes EPS

Q8: The degree of operating leverage is defined

Q9: _ leverage is increased by having greater

Q10: A 10% increase in sales causes EPS

Q11: Jerry's Dog Food,Inc.is a dog food wholesaler

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents