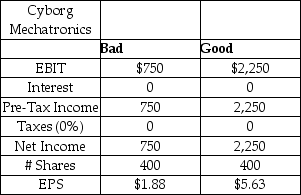

Cyborg Mechatronics is entirely equity financed with 400 shares outstanding and a market capitalization of $18,750 (P=$46.875) .Current financial data for Cyborg is provided in the table below for two states of nature,which correspond with two levels of sales.The standard deviation of EPS is $1.875.The CFO of Cyborg,John Conner,is considering a change in capital structure.In particular,he is thinking about borrowing $6,562.50.He will borrow the money by issuing perpetual bonds with a face value of $6,562.50 and a coupon rate of 6%.The borrowed money will be used to repurchase shares at $46.875 per share.Repurchased shares will be cancelled.Taxes are 0%.First,calculate the EPS in each state of nature if Cyborg borrows the money.Second,calculate the standard deviation of the EPS.What is the ratio of the standard deviation of EPS with the leveraged capital structure to the standard deviation under the current,all equity capital structure?

A) 0.54

B) 1.25

C) 1.54

D) 1.88

E) 2.89

Correct Answer:

Verified

Q22: Selected financial information for the Baltimore &

Q23: Which of the following statements about debt

Q24: What is the average debt ratio for

Q25: The financial analyst at Must-Peek Films found

Q26: Consider two firms that are identical in

Q28: Ferris Manufacturing is all equity financed.Current financial

Q29: A company posts a 25% increase in

Q30: Consider two firms that are identical in

Q31: A firm has an increase in EPS

Q32: Jerry's Dog Food,Inc.is a dog food wholesaler

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents