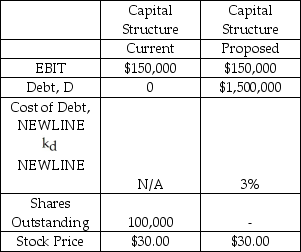

Selected financial information for the Baltimore & Ohio Railroad Corporation (B&O) is provided in the table below.B&O is currently all equity financed,but it is considering a leveraged capital structure,details of which are presented in the column labeled 'Proposed'.Under the proposed capital structure,B&O will use all of the new debt to repurchase (and cancel) shares.How many shares will be left outstanding after the repurchase,if B&O buys shares for $30.00 per share?

A) 50,000

B) 100,000

C) 75,000

D) 25,000

E) 33,000

Correct Answer:

Verified

Q17: Capital structure may be defined as

A) a

Q18: For a given level of EBIT,greater changes

Q19: The degree of financial leverage is defined

Q20: If sales are expected to increase 25%,EBIT

Q21: Gentech,Inc.is an integrated circuit (microchip)manufacturer based out

Q23: Which of the following statements about debt

Q24: What is the average debt ratio for

Q25: The financial analyst at Must-Peek Films found

Q26: Consider two firms that are identical in

Q27: Cyborg Mechatronics is entirely equity financed with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents